Year-End Ready: September Checklist for Canadian Owner-Operators

When September rolls around, most people are focused on back-to-school or the first signs of fall. But for Canadian owner-operators, this month is more than a seasonal shift—it’s your financial pit stop before year-end.

Just like you wouldn’t hit a long winter run without inspecting your truck, now’s the time to “pop the hood” on your finances. Waiting until December—or worse, tax season—means missed deductions, higher tax bills, and long nights buried in receipts.

At Truckers Pro CPA, we’ve helped drivers across Canada simplify year-end prep, reduce tax stress, and protect their hard-earned money. Here’s your September checklist to make sure 2024 ends strong and 2025 starts even stronger.

Why September Matters for Owner-Operators

Unlike company drivers, you don’t have an HR or payroll department smoothing things out. Your income rises and falls with the road, expenses spike without warning, and retirement planning is fully on your shoulders.

By checking in now, you’ll have time to:

- Catch errors or missing receipts before CRA does

- Adjust RRSP or TFSA contributions

- Plan for repairs or big-ticket purchases

- Avoid the December scramble and CRA penalties

Think of it as preventative maintenance—not for your rig, but for your financial engine.

Step 1: Review Income, Expenses, and Mileage

Start with the basics:

- Invoices: Make sure every invoice is recorded and follow up on late payments before they jam up your cash flow.

- Receipts: Fuel, tolls, repairs, insurance—organize them. A missing $20 slip here and there adds up fast.

- Mileage Logs: CRA requires accurate logs if you’re deducting vehicle expenses. Incomplete records = audit headaches.

👉 One focused hour this month can save you days of stress later.

Step 2: Maximize Deductions and Savings

September is the sweet spot for tax savings:

- RRSP Contributions: Lower taxable income and build retirement savings.

- TFSAs: Flexible, tax-free growth—great for emergency funds or semi-retirement.

- Prepaid Expenses: Insurance, software, or maintenance paid before year-end can boost deductions this year.

Small moves now = big savings come tax season.

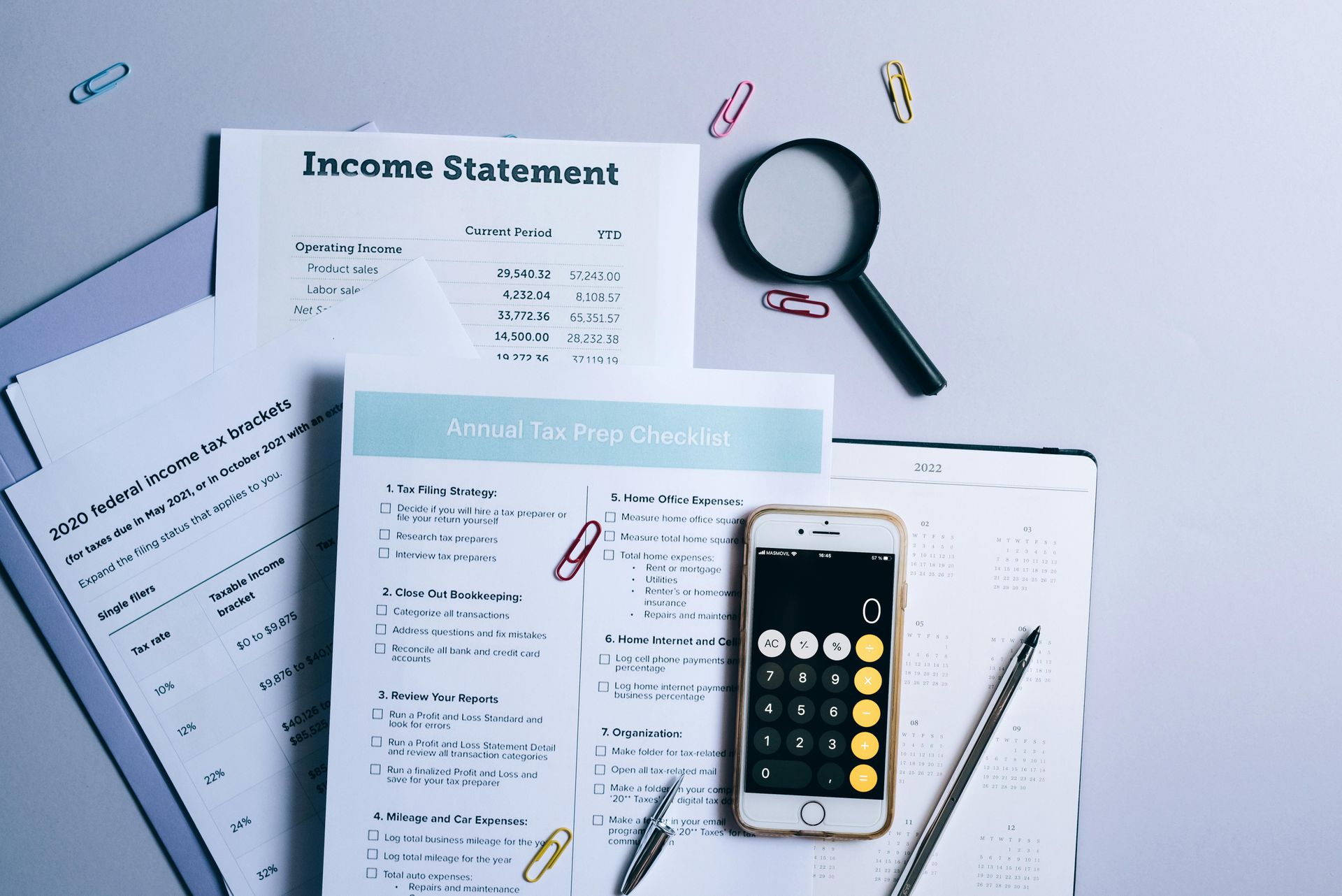

Step 3: Stay on Top of GST/HST and Payroll

Don’t leave GST/HST until year-end—it’s like ignoring a check-engine light.

- Match what you’ve collected vs. what you’ve paid

- Double-check payroll remittances if you have staff

- Claim all eligible input tax credits

Staying ahead now keeps your penalty-free and stress-free.

Step 4: Evaluate Equipment and Major Purchases

Fall is the perfect time to assess your rig and gear:

- Repair vs. Replace: Is it smarter to replace now or stretch another year?

- Capital Cost Allowance (CCA): New purchases can mean significant tax deductions.

Timing Strategy: Buying before year-end could lower this year’s taxes—but waiting may be smarter if income rises next year.

Step 5: Strengthen Retirement and Emergency Funds

Owner-operators often put retirement last. Don’t. Even small steps pay off long term:

- Top up RRSPs or TFSAs

- Contribute to a corporate account if incorporated

- Add to an emergency cushion for seasonal slowdowns

Even $200–$300 a month compounds into serious future security.

Real Story: From Shoebox Chaos to Year-End Control

One of our clients, a long-haul Owner-Operator from Ontario, used to push paperwork to December. Every January, he’d spend nights digging through shoeboxes of receipts—only to realize he’d missed thousands in deductions.

Last September, we helped him set up a simple checklist: updated mileage logs, prepaid insurance, and an RRSP top-up. The result? His tax bill dropped by nearly $6,500—and for the first time, he rolled into the new year with his books 100% up to date.

His words:

“I finally feel like I’m in the driver’s seat of my business, not just my truck.”

How Truckers Pro CPA Keeps You Road-Ready

At Truckers Pro CPA, we know your truck isn’t the only thing that needs regular checkups—your finances do too. Our year-end support helps you:

- Reconcile income, expenses, and mileage

- Maximize deductions and retirement contributions

- Stay compliant with GST/HST and payroll rules

- Strategically time equipment purchases

By tackling these steps in September, you’ll finish the year organized, confident, and ready to roll into 2025 without financial roadblocks.

👉 Don’t wait until the December crunch.

Book your free consultation

with Truckers Pro CPA today, and let’s build your custom year-end checklist together.

Popular Posts

Marcel Coviciu

Marcel began his career working in operation and management for a major tire manufacturer. Then he transitioned into trucking, running his own business for 15 years and ultimately working his way through accounting school. Fascinated with the way logistics and financial management impact the profitability of businesses, Marcel loves sharing his expertise with other truckers.